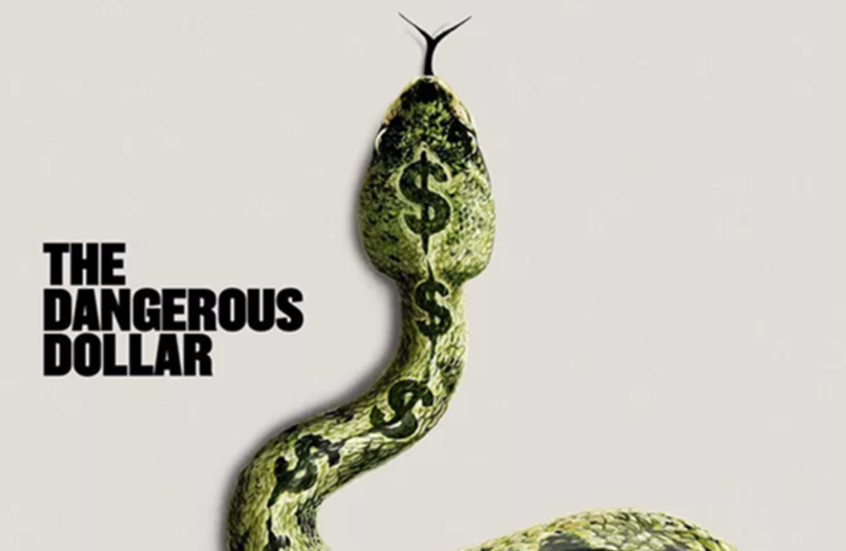

The Economist Warns of Dollar Volatility: New Cover Features a Snake

The dollar has depreciated against major currencies.

The main article is titled: "The Era of the Fluctuating Dollar in Decline. U.S. Asset Holders Must Adapt."

Trade data indicates that the Dollar Index, which measures the value of the U.S. currency against a basket of major currencies, has fallen by approximately 10% since President Donald Trump's inauguration in January 2025, with a roughly 15% decrease against the euro.

U.S. Stocks Reach Record Highs Despite Fluctuations

Despite the dollar's weakness, U.S. markets have performed strongly; the Dow Jones Index has risen by more than 10%, while the NASDAQ Index has increased by about 15% during the same period, though it remains approximately 6% below its historical peak in October 2025.

The magazine notes that U.S. economic growth is still admired globally, albeit accompanied by significant market volatility.

Investor Anxiety on the Rise

The magazine observed that investor anxiety has become more common, particularly in April 2025 when Trump announced a "base tax" on imports, prompting investors to collectively divest their U.S. assets, resulting in a sharp drop in both stock and dollar values.

This phenomenon, traditionally associated with emerging markets, has occurred seven times in the past 52 weeks, three times faster than in the previous decade.

Gold Prices Rise as a Safe Haven

In response to the uncertainty, gold prices have surged by 75% since the beginning of Trump's second term, exceeding $5,600 per ounce for the first time in late January 2026, serving as a warning signal for investors regarding the fragility of U.S. financial strength amid volatility.

The magazine commented: "This should give pause to those who believe in the unshakeable financial strength of America."