Mohamed Mansour Returns to Egypt Amid Global Tax Changes

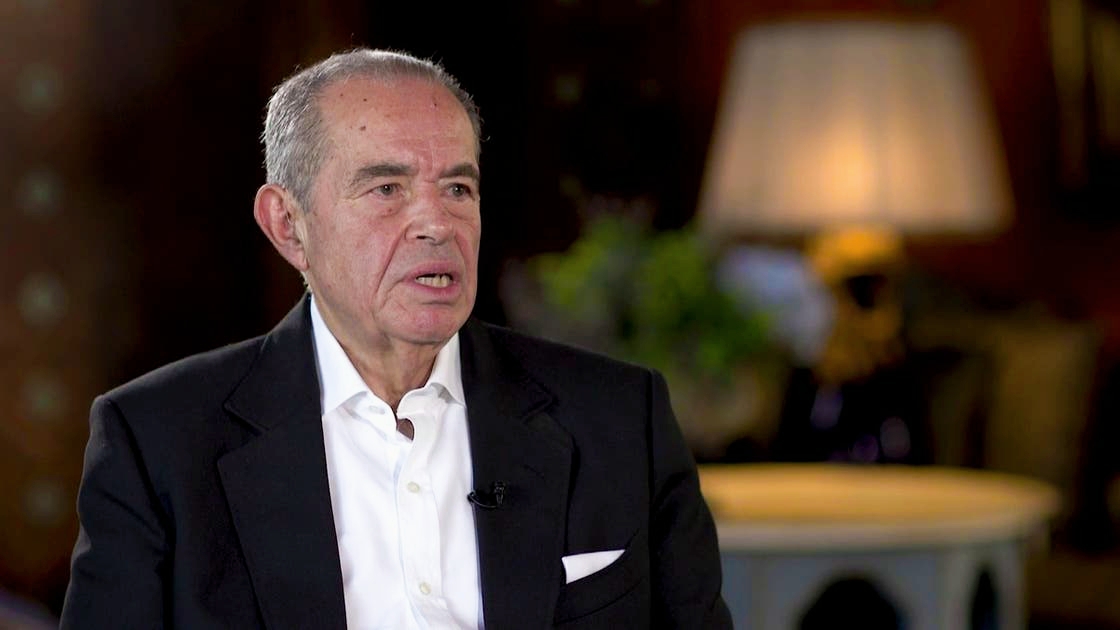

After more than eight years in the United Kingdom, prominent Egyptian businessman Mohamed Mansour has officially changed his residency to Egypt, according to records from the UK Companies House.

This move marks the latest development in a trend of wealthy individuals leaving the UK following recent increases in taxes on high earners and the affluent.

Mansour, 77, is recognized as a major donor to the UK Conservative Party, having made a record donation of £5 million (approximately $6.7 million) in 2023 after taking on the role of party treasurer.

Additionally, he was knighted by the UK last year in recognition of his contributions to the economy, charity, and politics.

In exclusive statements, Mansour announced the commencement of production at the "Mack" automotive plant in Egypt, which will have a local ownership stake of 40%, reflecting his intent to expand his business activities in his home country.

While the official reasons for his return have not been disclosed, experts suggest that the recent tax reforms in the UK played a crucial role in Mansour's decision. This is particularly relevant following the tightening of residency tax rules in March 2024, which require non-residents to pay taxes on foreign income after just four years, alongside the Labour government's trend of eliminating tax exemptions on inheritance from foreign assets.

Mansour is among the early investors in major technology firms such as Airbnb and Spotify and was one of London's wealthiest residents, managing his business from the upscale Mayfair district.

The Mansour Group, which he chairs, was founded in 1952 as a cotton trading company and has since evolved into a diversified conglomerate based in Cairo, engaging in real estate, food, and manufacturing, including ownership of one of the largest "Caterpillar" dealerships globally.

This move comes at a time when the UK is witnessing an increasing exodus of wealthy individuals, with others, such as the founder of the fashion group Bestseller, returning to their home countries like Denmark and Belgium, while some relocate to tax-friendly regions such as Monaco and the United Arab Emirates.

Through his return to Egypt, Mansour reaffirms his commitment to investing in his home country and continuing his economic and charitable initiatives there.