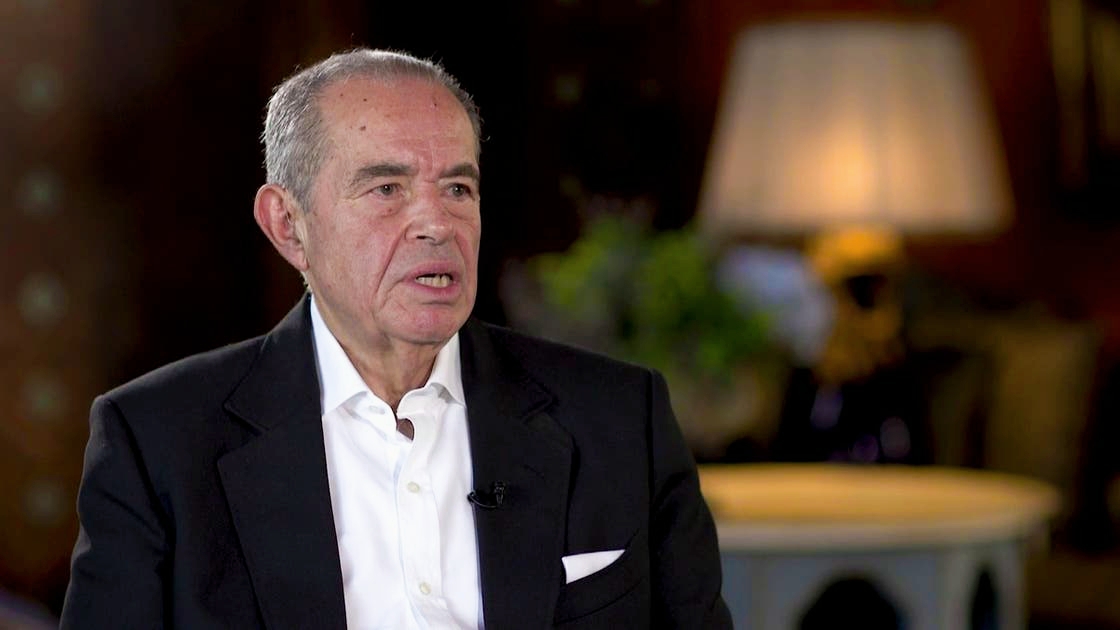

Egyptian Businessman Mohamed Mansour Returns Home from the UK Amid Tax Changes

After spending more than eight years in the United Kingdom, prominent Egyptian businessman Mohamed Mansour has announced his return to Egypt, as confirmed by the UK Companies House.

This decision marks another instance of wealthy individuals leaving the UK following the government's increased taxes on high-net-worth individuals and high earners.

At 77 years old, Mansour is a notable benefactor of the UK Conservative Party, having made a record donation of £5 million (approximately $6.7 million) in 2023 after taking on the role of party treasurer.

Additionally, he was honored with a knighthood last year for his contributions to business, charity, and politics in the UK.

In an exclusive statement, Mansour revealed plans to commence production at the "Mack" automobile factory in Egypt, which will utilize 40% local components, reflecting his commitment to expanding his business activities in his home country.

While official reasons for his return have not been disclosed, experts suggest that the recent tax reforms in the UK played a significant role in Mansour's decision. These reforms include stricter residency tax rules implemented in March 2024, which require non-residents to pay taxes on foreign income after just four years, alongside the Labour Party's move to eliminate tax exemptions on foreign asset inheritance.

Mansour has been an early investor in major tech companies such as Airbnb and Spotify, and he was among the wealthiest residents in London, managing his affairs from the upscale Mayfair district.

The Mansour Group, which he leads, began in 1952 as a cotton supplier and has since evolved into a diversified conglomerate based in Cairo, operating in real estate, food, and manufacturing, including being one of the largest global distributors of "Caterpillar" construction equipment.

This return comes at a time when the UK is witnessing an uptick in wealthy individuals relocating, with others, such as the founder of fashion group Bestseller, opting to return to their home countries like Denmark and Belgium, while some have moved to low-tax regions such as Monaco and the UAE.

Mansour's decision to return to Egypt underscores his commitment to investing in his homeland and further developing his economic and philanthropic endeavors there.