Gold and Silver Prices Surge Amid U.S. Monetary Policy Changes

February 3, 202643 VistasTiempo de lectura: 2 minutos

Tamaño de fuente

16

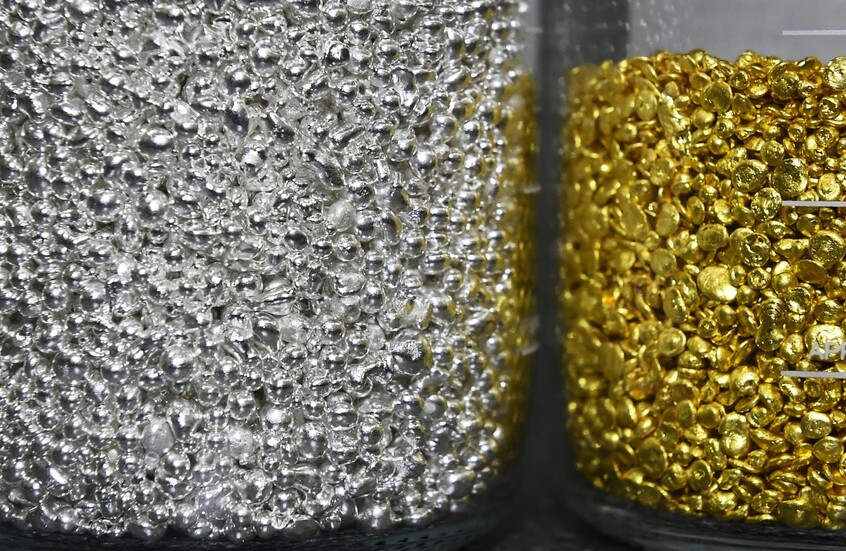

Gold and silver prices experienced substantial gains during trading on Tuesday, recovering from a recent wave of sharp sell-offs that had driven prices to their lowest levels in weeks. This rebound was fueled by shifts in investor sentiment.

Gold Gains Over 4%

April gold futures rose by 4.16%, reaching $1,846.29 per ounce as of 08:25 Moscow time. Additionally, spot gold prices increased by 3.44% to $1,821.56 per ounce, following a session where gold hit its lowest level in nearly a month.

Silver Jumps Over 8%

Silver showed an even stronger performance, with March futures rising by 8.21% to $23.33 per ounce, marking one of the most significant daily increases in recent times.

U.S. Monetary Developments Driving Market Fluctuations

The price movements followed a significant sell-off triggered by the nomination of Kevin Warsh to chair the U.S. Federal Reserve, raising concerns among investors about the future of U.S. monetary policy and its implications for safe-haven asset prices.

Experts: Prices Returning to Natural Levels

Kyle Rodda, a leading market analyst at Capital.com, noted that current prices appear to be more aligned with their fair value after a period of irrational fluctuations in the markets over the past weeks. He added that the recent increase has brought gold and silver back to levels seen in early January 2026.

Record Gains Since the Start of the Year

In January, gold recorded an approximate 13% increase, marking its largest monthly gain since November 2009, while silver prices surged by 19%, reflecting ongoing demand for precious metals as safe havens amid global economic fluctuations.