Gold and Silver Prices Rebound Following Market Sell-Off Amid U.S. Monetary Policy Changes

February 3, 202637 ViewsRead Time: 2 minutes

Font Size

16

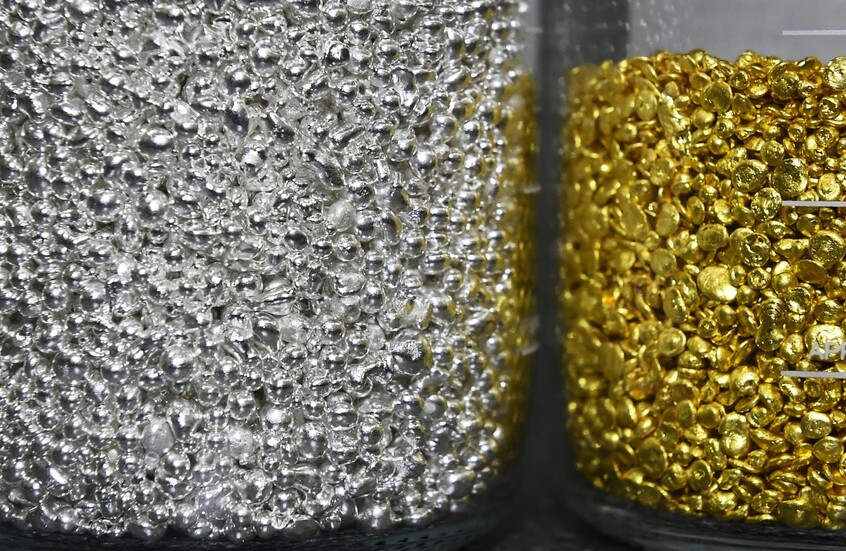

Gold and silver prices experienced a significant rise during trading on Tuesday, following a recent market downturn that had pushed prices to their lowest levels in weeks. The recovery was fueled by a shift in investor sentiment.

Gold Gains Over 4%

April gold futures increased by 4.16%, reaching $4,846.29 per ounce at 08:25 Moscow time. Spot gold prices also rose by 3.44%, hitting $4,821.56 per ounce, after touching a near-month low in the previous session.

Silver Surges Over 8%

Silver demonstrated an even more robust performance, with March futures rising by 8.21% to $83.33 per ounce, marking one of the largest daily increases in recent history.

U.S. Monetary Policy Influences Market Movements

The recent price fluctuations followed a sell-off triggered by the nomination of Kevin Warsh for the chairmanship of the U.S. Federal Reserve. This development raised concerns among investors regarding the future of U.S. monetary policy and its potential impact on safe-haven asset prices.

Analysts: Prices Aligning with Fair Value

Kyle Rodda, Senior Market Analyst at Capital.com, stated that current prices appear to be approaching their fair value after a period of erratic market behavior. He noted that the recent gains have brought gold and silver back to levels not seen since early January 2026.

Significant Year-to-Date Gains

Gold has recorded a 13% increase in January, marking its largest monthly gain since November 2009, while silver prices surged by 19%, reflecting ongoing demand for precious metals as safe-haven investments amid global economic volatility.